Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

With shared ownership mortgages perhaps considered as a specialist mortgage, it may be more difficult to find a company who knows the ins and outs and can process your mortgage quickly and efficiently. Here at First Choice Finance our quarter of a century`s experience in the mortgage sector has afforded us the knowledge and expertise required to get the best possible deals on shared ownership mortgages from our lender panel enabling our clients to get on the home ownership ladder. If you would like to talk through your options without obligation and get a free quotation simply start by filling in our on line enquiry form, alternatively speak directly to one of our friendly advisers on our free phone number 0800 298 3000 (landline) or dial 0333 003 1505 (mobile friendly).

With shared ownership mortgages perhaps considered as a specialist mortgage, it may be more difficult to find a company who knows the ins and outs and can process your mortgage quickly and efficiently. Here at First Choice Finance our quarter of a century`s experience in the mortgage sector has afforded us the knowledge and expertise required to get the best possible deals on shared ownership mortgages from our lender panel enabling our clients to get on the home ownership ladder. If you would like to talk through your options without obligation and get a free quotation simply start by filling in our on line enquiry form, alternatively speak directly to one of our friendly advisers on our free phone number 0800 298 3000 (landline) or dial 0333 003 1505 (mobile friendly).Shared Ownership Mortgages Explained

Shared Ownership is an affordable home ownership scheme that is provided by Housing Associations all over the UK. If you can`t afford to buy a property outright it gives you the opportunity to part buy and part rent your home. On shared ownership mortgages you only need to raise the deposit for the share that you are purchasing. Generally that means having to save a lot less initially. Once the mortgage is in place you pay a mortgage on the share you have bought (25%-75% of the property value) and pay subsidised rent on the share that you don`t own. If you so wish there is normally the option to buy further shares until you own 100% of the property. With this in mind, it provides a great way for you to get your foot on the property ladder and in to home ownership and you can then aim to buy out the rest of the property as and when you are able to, subject to the schemes approval of course.

Once the mortgage is in place you pay a mortgage on the share you have bought (25%-75% of the property value) and pay subsidised rent on the share that you don`t own. If you so wish there is normally the option to buy further shares until you own 100% of the property. With this in mind, it provides a great way for you to get your foot on the property ladder and in to home ownership and you can then aim to buy out the rest of the property as and when you are able to, subject to the schemes approval of course.Shared Ownership Pros & Cons

The good points:- It can help you make that first, often big step on to the property ladder.

- It allows you to work towards, and eventually own your property outright, as and when you can afford to.

- Depending on your location and other factors, it can work out cheaper than renting and you will be building up equity in a property if prices rise.

- As you own a portion of the property, if house prices rise, you will also benefit from the increase in value if you decide to sell the property.

- Not all properties will allow shared ownership mortgages. Unfortunately there may not be any properties that you like in your area.

- You will have to pay a small service charge to the housing association on top of your mortgage, this could even continue if and when you own 100% of the property.

- There could be extra fees involved when you try to purchase more shares of the property.

- If you have the income available but only a small deposit, you could consider other options like a 95% mortgage and only have to pay a mortgage on the property without having to rent the other proportion of the property you live in. Weighed up your options and would like to enquire? Fill in the one minute application form at the top of the page and we will contact you to discuss your enquiry without obligation.

Government Shared Ownership Schemes

It is important to understand that shared ownership mortgages are not necessarily government schemes, instead they are provided through housing associations. To explore all of your options if you are working with low income or a small deposit, you may also be interested in the `Homebuy` or `Help to Buy` schemes that the government does provide. For more information on these government schemes or your options if you are only able to save a small deposit, head over to our page on low deposit mortgages.Mortgage Calculators

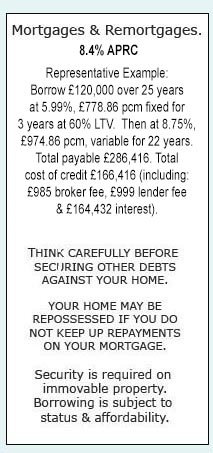

A reason for considering shared ownership mortgages could be down to your affordability and the fact that you might not be able to afford to purchase 100% of a property. If this is the case, it is vital to ensure that you can financially afford the mortgage and that the repayments, along with the extra rent you will need to pay to the housing association will be a manageable amount. If you would like a brief idea of the payments you could face on the mortgage alone, head over to our mortgage calculator page to get an idea of the numbers in front of you. Once you have an idea, you can make a decision based on the figures. If you would prefer to talk this through with an adviser then give us a call on 0800 298 3000 (landline) or 0333 003 1505 (mobile friendly).THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential